Warren Buffett has been dubbed ‘a true legend and king of investing’ after a graph showing his portfolio growth over a 28-year span.

The American business magnate, investor and philanthropist is one of the best-known fundamental investors in the world thanks to his incredible investment success.

With a net wo rth of $106 billion as of March 2023, the 92-year-old, from Omaha, Nebraska, is the fifth richest person in the world.

Advert

Buffett's company, Berkshire Hathaway, has an incredible portfolio, including behemoth companies like Coca-Cola, Bank of America, Procter & Gamble, Mastercard Inc, Goldman Sachs and more.

Since 1994, Buffett’s portfolio has also included ABC, American Express, Gillette, Walt Disney, McDonald’s, Washington Post, IBM among other business heavyweights.

Today, his portfolio - which in investment refers to a collection of assets like stocks, bonds, mutual funds and exchange-traded funds - includes Apple, Chinese electric car manufacturer BYD, US Bancorp, Verizon, Moody’s, Coca-Cola, American Express, Bank of America and cash.

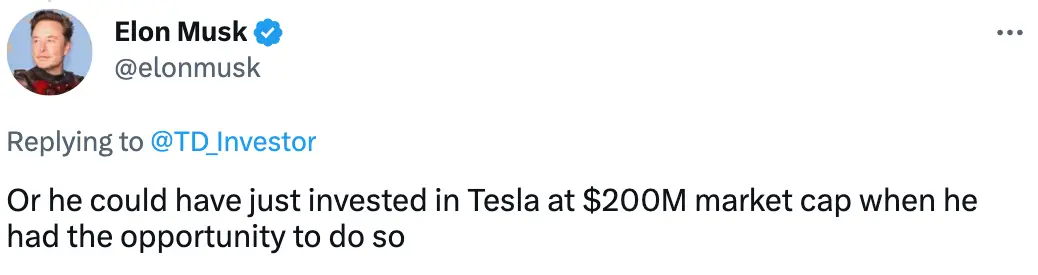

A tweet shared by The Defensive Investor showing Buffett's incredible growth between 1994-2022 has been viewed over five million times and even got a reaction from Twitter boss Elon Musk, who said: "Or he could have just invested in Tesla at $200M market cap when he had the opportunity to do so."

Despite Musk's response, investors have praised Buffett’s ability to choose which stocks to invest in and he’s been lauded for following value investing principles consistently.

Instead of investing in the ‘next big thing’, he uses his ability to identify long-term profitable investments when building his portfolio.

Basically, value investing involves buying stocks that appear to be undervalued. You then sell the stocks years later once they’ve reached their deserved market value.

However this strategy requires excellent market and business knowledge which smany casual investors probably don’t have.

A value investing philosophy is based on the notion that the market overacts to the media and sentiment which hides the actual value of many stocks, leading to some of them to be under-priced.

The intrinsic value of a share is looked at when practicing value investing, instead of technical indicators like moving averages, momentum indicators or volume.

To pick winning stocks, Buffett’s strategy starts with evaluating a company based on his value investing philosophy. He looks at companies that have a good return on equity over many years, especially when compared to rival companies in the same industry.

When putting together his portfolio, Buffet seeks to understand a company’s financials and whether the company has provided a positive return of equity (ROE) for many years, he prefers earnings growth to come from shareholders’ equity (SE) since a company with positive SE means it generates enough cash flow to not have to rely on debt to keep it going.

He also zeroes in on companies that provide a unique product or service that gives it an advantage over others.

The value investing concept was pioneered by Benjamin Graham and Buffet modeled his own investment philosophy after Graham while studying at Columbia Business School.

He went on to attend New York Institute of Finance to focus on his background in economics and soon after began various business partnerships, including one with Graham.

Some of the biggest things we can learn of Buffett’s portfolio and his investing style is to invest in companies you know a lot about, the uniqueness of its product or service - let’s face it, no one will ever be able to top a can of Coke or a Disney film - and to invest with the long term benefits in mind.