A businessman was shocked to discover 1,400 shots of tequila were added to his bar tab while on a night out in Vietnam.

We all dread looking back at our bank account from the night before to confirm how many rounds of Fireball we bought while, in the words of Matthew McConaughey, making ‘each day count’.

And boy, did our wallet pay.

However, at least you're not this bloke.

Advert

One man's discovery on his American Express card is everyone’s worst nightmare.

The Herald Sun reported that an Australian businessman challenged a $45,000 bill he received in Vietnam.

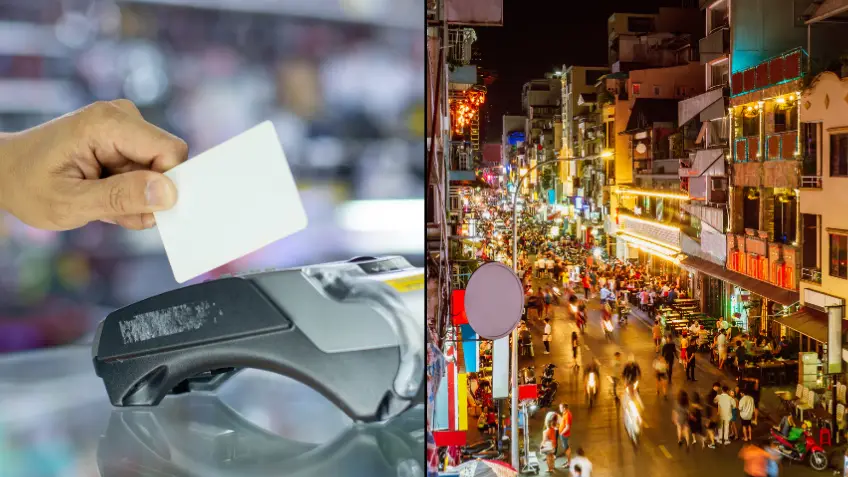

The man insisted that the total amount he had spent while partying it up at the Ho Chi Minh City bars - Bottoms Up and Double Shots - was $3,300.

In his complaint to Australian Financial Complaints Authority (AFCA), the man, known as ‘Mr S’, said he handed his card to bar staff after being given hand-written bills for much smaller amounts, around $600 and $1100.

Just as he was about to enter his PIN, staff informed him he didn’t need to as the EFTPOS machine was down. He also wasn’t required to provide a signature.

Upon returning from his trip, Mr S was made aware of the charges after realising his American Express card was maxed out.

He then looked through previous statements when he stumbled across the hefty bills.

According to AFCA, Mr S initially disputed the charges with Amex, prompting them to contact the bars, which provided itemised and signed records of the $45,000 bill.

The bill included 1,400 shots of tequila, 369 Lady Drink, 122 Jagers and a bunch of other stuff.

In a letter to Mr S, Amex said: “On the basis of the information provided and the results of our investigation, the final conclusion reached is that we believe (the transactions) to be valid and correctly executed.

"Therefore, the amount previously under review has been reapplied to your account balance and you will see this on your forthcoming statement.”

However, AFCA revealed the signatures provided were ‘illegible scrawl’, and didn’t bear any resemblance to Mr S’s genuine signature'.

AFCA added that the bill had also been created through a simple Word Doc and that ‘a foreign tourist or businessman such as Mr S was the ideal target’.

Technically, under the ePayments Code, American Express was liable for the disputed charges.

Ultimately, the man only had to pay the $3,300 he admitted to spending on the night out.

Big phew!