Martin Lewis has delved into credit scores on a recent episode of his money show, explaining why they 'aren't real'.

During ITV's Martin Lewis Money Show Live on Tuesday (3 December), Martin explained what a credit score actually is and how to boost your chances of being accepted for a loan.

"What is the most important factor in determining your credit score?" One audience member asked, which prompted Martin to debunk the concept of a credit score and what actually contributes to a lender approving a loan.

Advert

"You don't have a credit score. You don't have one," he said.

"There is no single number that dictates if a lender will accept you.

"Each individual lender scores you differently based on it own wish list - not just about risk but what is profitable as a customer.

"The credit reference agencies market a credit scoring tool but it is just their idea, a rough example, of how a typical lender may look at you.

"It isn't rock solid, it isn't official."

Essentially, Martin explained that a credit score is basically an estimation of how lenders view your financial profile.

Instead of stressing about slight changes in your credit score, it's best to focus on measures that make you more favourable to lenders.

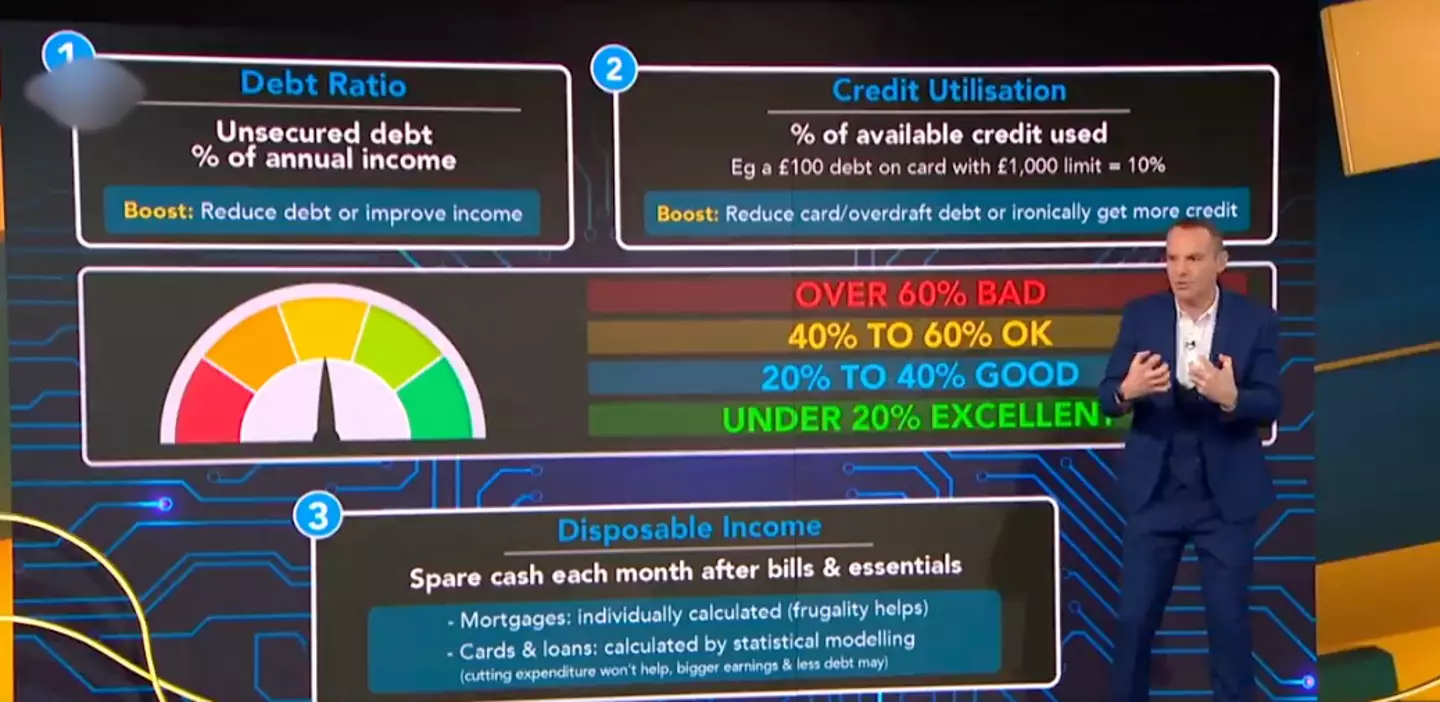

Use a debt ratio

Martin explained that lenders look at how much debt you have as a percentage of your annual income.

As an example, Martin explained: "Say you've only got a £10,000 credit card, you earn £40,000 - that is a 25 per cent debt ratio. Lower is better."

To boost this, you'll need to reduce debt or boost your income.

Credit utilisation

Lenders also look at credit utilisation, which is an assessment of how much credit you're using.

For example, if you have a £1,000 credit limit and you're £100 in debt, you have a 10 per cent credit utilisation.

This can be improved by using less of your overdraft or surprisingly, increasing your credit.

Disposable income

Martin explained that if you're about to apply for a mortgage, for example, you should be 'going frugal' and trying to increase your disposable income - aka the money you have left once bills have been paid.

This is because lenders actually look at how much money you have left in your account via statements.

However, for credit cards and loans, lenders don't have access to your statements, so they look at what a person in your circumstances would likely do, rather than assessing your accounts.

"The amount you earn and the amount of debt you have is factored in, so if you could earn more and reduce your debt, it could help on the disposable income," said Martin.

Maintaining your credit file

Finally, Martin explained that making sure your credit file is up to date and correct is important.

For example, check for any mistakes or incorrect addresses as these can impact your file.

"I want you to go through these reports, line by line, even small errors can mean rejection," Martin said.

"If you've got an old mobile phone contract that's closed, but it's linked to the wrong address, that could kibosh a mortgage deal."

Topics: Money, Martin Lewis, News, UK News