Donald Trump's decision to impose tariffs on all countries has had a catastrophic effect on the stock market, but how will it affect pensions?

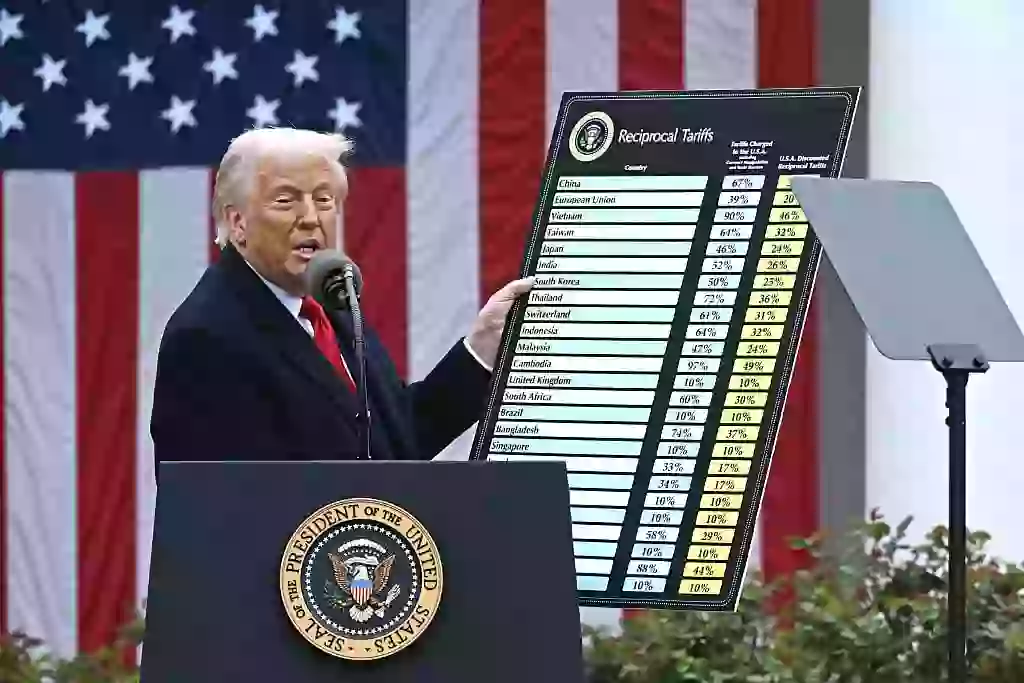

'Liberation Day' came and went on 2 April, with an array of tariffs being introduced worldwide, but luckily, the UK got off lightly compared to the likes of China, who saw a 50 percent increase in their tariffs up to a whopping 104 percent.

As a result, the trade market took a big hit, with stocks dropping massively in value and the US overseeing the worst two consecutive days in the history of their stock market.

Worse than the Great Depression, Black Monday, the 2008 financial crisis and even COVID. That's some feat.

Around $6.6 trillion in value was wiped over this period, as the full list of tariffs stopped nations all over the world in their tracks.

The toll it has taken on the economy is unprecedented, and some of those looking to take pensions out should be wary for good reason.

From young people to recent retirees, everyone will be affected in some way by the US President's decision.

Which type of pension won't be impacted?

In the UK, there are two types of private pension.

Firstly, a defined benefit (DB), which is also called a final salary, and is common in the public sector.

And secondly, there's a defined contribution (DC) pension.

Lucie Spencer, the financial planning parter at Evelyn Partners, told Sky: "Those who have a DB pension should be largely unaffected as their payouts are fixed and guaranteed."

Unfortunately, those with DC schemes will be hit hard, as they are more exposed to the now volatile US market.

It's not all doom and gloom though, as the head of DC Investment strategy at Hymans Robertson, Anthony Ellis, explained that most DC scheme users used default strategies that would de-risk, meaning the money is moved into safer cash and bonds, as you approached retirement.

Trump's tariffs will affect a number of pensioners (Getty Stock Image) Which type of pension is impacted the worst?

Your retirement could be delayed, if you are either planning to become a pensioner, or have recently become one.

Mark Chicken is a chartered financial planner at The Private Office, and he admitted that this was 'possible' and people 'could have to come out of retirement', adding: "If someone's pension wealth is 100% invested in global equities... and if their retirement plans were thin, then absolutely."

Essentially, being overly exposed to global equities could cost you dearly.

Those in their 50s could see their equity-invested pension take a dive, as Ellis said that a '15-20 percent drop in their funds' may be seen.

He advised those people that the recovery is 'usually relatively short', claiming that the market will recover, eventually.

But what about youngsters planning for the future?

Chicken essentially told those in their 40s or below to 'not worry about this at all', as young people should keep investing in their futures, with retirement decades in the distance.

Experts have urged those with stronger portfolios not to panic (BRENDAN SMIALOWSKI/AFP via Getty Images) What should people do if their pensions are impacted?

Chicken urged people not to make any 'dramatic decisions', while Ellis claimed: "Most people have a pretty terrible track record of timing the market.

"If you panic and take out your money you're almost certain not to time it in the best way," he claimed.

His advice was to hold on, and a 'knee-jerk panic' would be one of the worst things to do.

"Just carry on and see out this pretty bumpy ride and don't look at your pension value too much," the expert urged.

Joshua Nair

Joshua Nair