To make sure you never miss out on your favourite NEW stories, we're happy to send you some reminders

Click 'OK' then 'Allow' to enable notifications

To make sure you never miss out on your favourite NEW stories, we're happy to send you some reminders

Click 'OK' then 'Allow' to enable notifications

Drivers who owned a car between the years of 2007 and 2021 are being urged to check if they could be owed compensation.

If you took out car finance during this period, you might be in for some payback, after The Financial Conduct Authority (FCA) announced it would be undertaking a review into people being overcharged while taking out loans for their vehicles.

Simon Evans, chief executive of trade group Consumer Redress Association, said: “If you think about the number of people who have bought cars in the last decade-and-a-half, there is a swathe of people who will have bought it in that way.

Advert

“What we are seeing through our member firms who are engaging with consumers at the moment is that actually each person has an average of about 2.3 claims. So they have had two or three cars in that period and all of those qualify for a claim.”

The issue impacts a multitude of vehicles, including cars, vans, motorbikes and camper vans.

The finance must have been taken out before 28 January 2021 and after April 2007.

Advert

Another stipulation is that it must have been used mainly for personal use and not for business reasons.

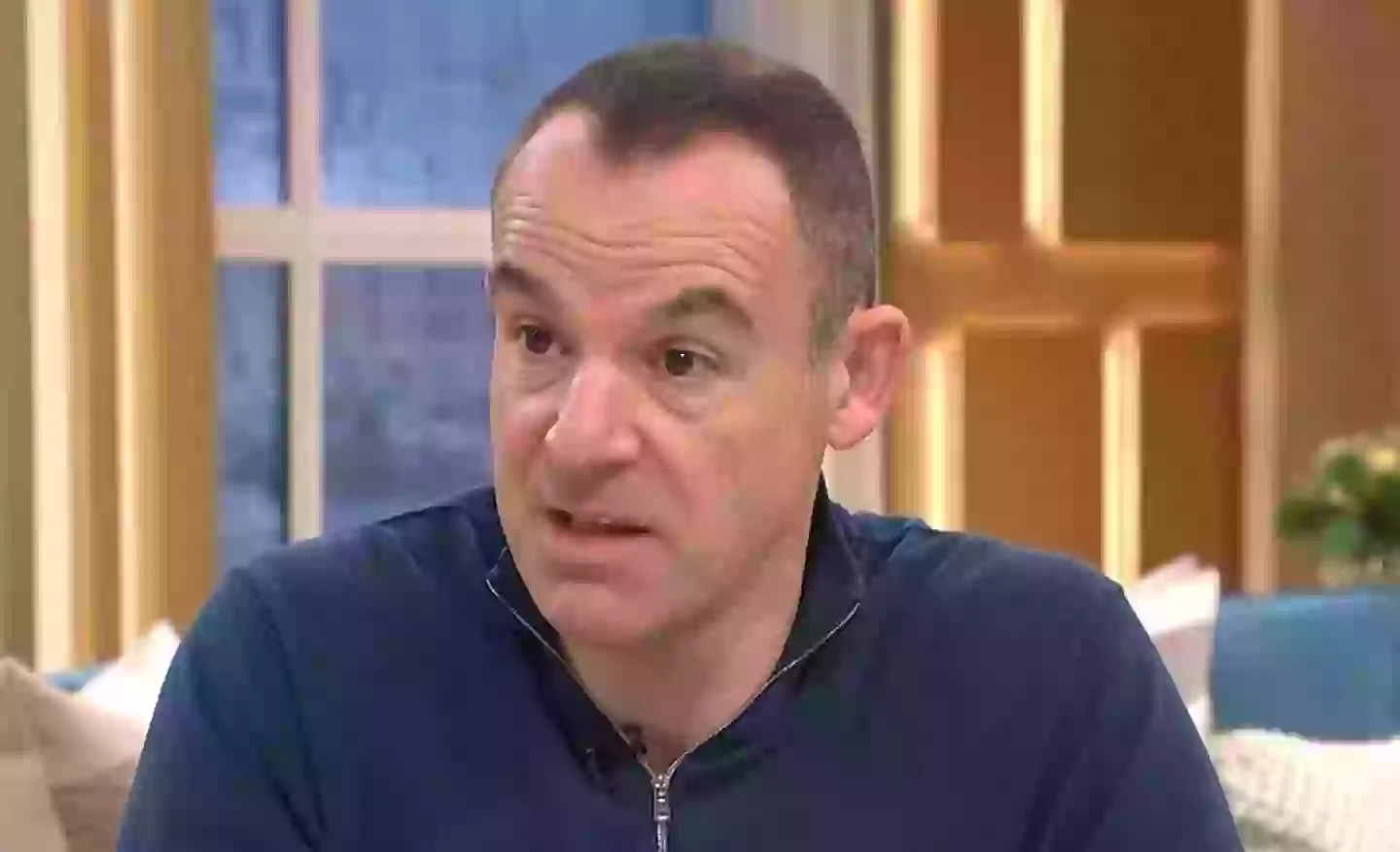

Martin Lewis has spoken about the issue a number of times, pointing out that it does apply to PCP purchases and you can claim even if you've paid the finance off.

He spoke about the scandal on a The Martin Lewis Podcast episode released to BBC Sounds in March.

Lewis said: "In January 2021, the FCA banned discretionary commission arrangements and in January this year it launched a huge mis-selling investigation. A seismic investigation that frankly I don't believe it would have done unless it thought there was some evidence of systemic wrongdoing.

Advert

"And just in the last week, the regulator's boss, the FCA boss, he has said 'it's improbable the investigation will find no evidence of wrongdoing'. Which is one of the strong indicators that a pay out is going to have to come.

"The other is that Lloyds which owns Black Horse, which is the most complained about firm [via Lewis' help form], has put a £450m provision towards potential costs and pay out for this.

"And we've heard today that Close Brothers has put aside money to pay for this. So this is big money."

Current estimates say it could cost the finance industry some £16 billion.