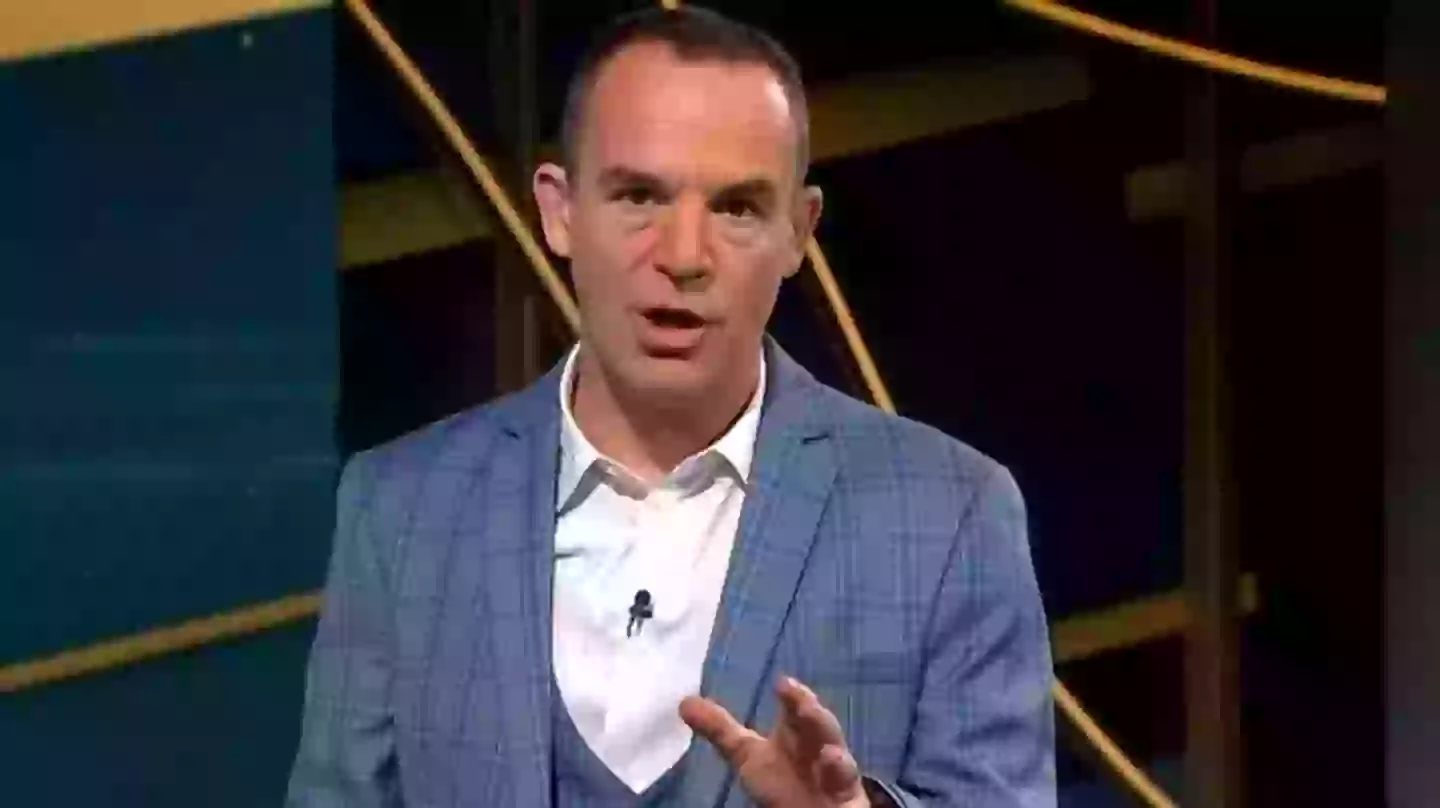

Money Saving Expert Martin Lewis has issued a warning about cash ISAs and what options are available.

If your personal and financial circumstances allow you to keep ahold of your money, then it might be worth sticking those savings away in an ISA for tax purposes.

What is a cash ISA?

During a recent episode of The Martin Lewis Money Show Live on ITV, the finance guru explained that 'a cash ISA is just a savings account where the interest is never taxed'.

Advert

"It's no more complicated than that," he said, clarifying that anyone over the age of 18 can put up to £20,000 in an ISA, each year.

£20,000 ISA allowance warning

Lewis says if you're thinking about getting an ISA and using it to its full capacity, then make sure you do so by 5 April.

"You can put in £20,000 per tax year, in a cash ISA or in ISAs in general. Go quickly though as if you need to fill this year's while as the deadline is 5 April. In practice many of the product providers close early for admin reasons," he added.

Advert

"The important thing to understand is once your money's in a cash ISA it's tax free year after year. So you could put, if you were lucky enough to have the money, you could put, if you haven't used your ISA this year, £20,000 in now."

On the major long term benefit, Lewis said: "Then on 6 April you get another £20,000 that you could put in. Now you've got £40,000 in. If things don't change the year after you could put another £20,000 in."

Different types of ISAs

On Lewis' Money Saving Expert website, it recommends to pick either an easy access ISA, which allow withdrawals, or a fixed-rate ISA.

Easy access ISA

• Trading 212 – 5.25 percent (for three months)

Advert

• Tembo - 4.8 percent (top straight rate)

• Post Office - 4.4 percent (top 'big name')

Fixed-rate ISAs (with access)

• Shawbrook Bank – 4.5 percent for one year

• Close Brothers – 4.41 percent for two years

Advert

You can open and pay into multiple cash ISAs at a time

If you wanted, you could pay into an easy access account and a fixed rate account at the same time over the course of each tax year. This includes with two different providers.

However, the total amount across all your ISAs can't go over the £20,000 allowance.

Chancellor Rachel Reeves' rumours to cut the ISA allowance to £4,000

There have been rumours circulating around that Chancellor Rachel Reeves is allegedly planning a cash ISA limit cut from £20,000 to £4,000.

Advert

But The Guardian reported last week that no ISA price cuts are set to be announced in the spring statement this month.

Lewis added: "The only rumour I've heard is dropping the future allowance from £20,000 to £4,000. Apparently it's not coming in the Spring Statement - I don't have that confirmed that's other people's reports.

"But it might come in the Autumn Budget. It's still being considered no decisions been made. If that's right let's just make it plain for everyone. Some people are saying 'take money out of cash ISAs' that would be bonkers - bonkers."

Topics: UK News, Money, Martin Lewis, Politics