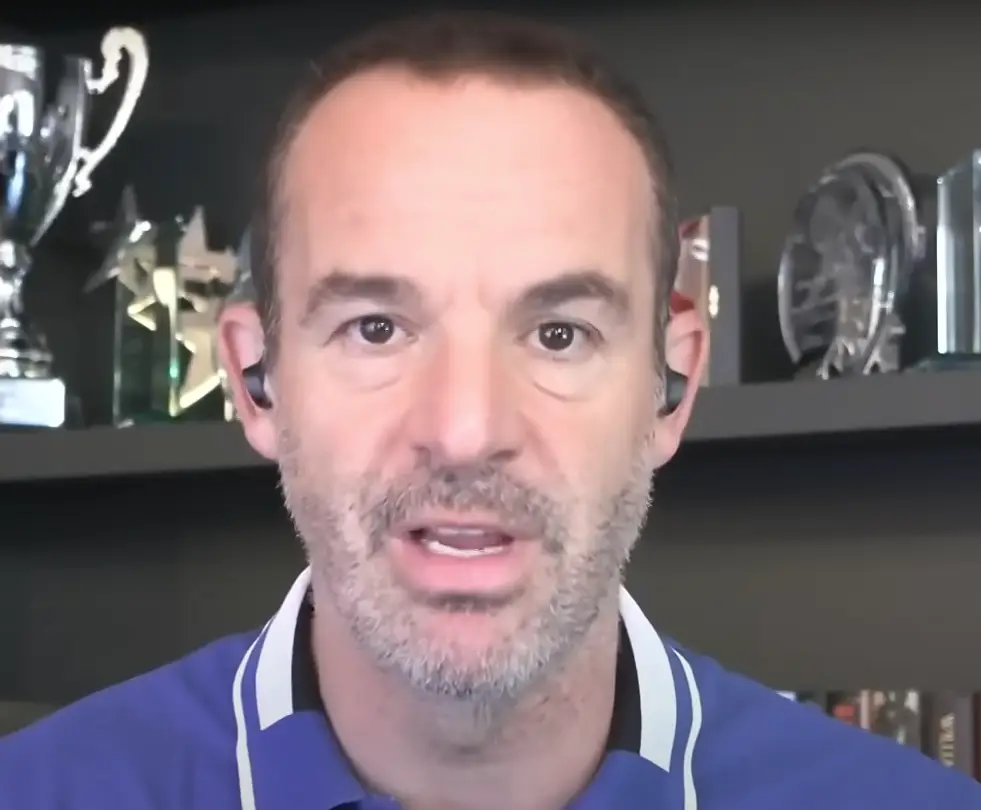

Martin Lewis is a godsend when it comes to saving money. From a few quid here and there to knocking hundreds off of your bills, he is the man to go to when you need to keep the costs down.

That is certainly the case when it comes to the annual headache of car insurance renewal.

And going by data from the Association for British Insurers, it's a headache that's slowly been turning in to the mother of all migraines.

Advert

The average car insurance cost right now sits at £635. That's up from £416 in 2022, a whopping rise of 52%.

It comes after October 2023 showed that the average premium was going for £924 a year, according to Lewis himself, who said by March this year the premium had gone over £1,000 for an average 12 month policy.

But as well as highlighting the issue, Lewis issued some cracking advice that could save you a shed load.

His team at Money Saving Expert had analysed some 70 million quotes to produce their top tips; which includes a very particular sweet spot.

What's the advice?

It's all about timing, you see. When you're renewing, you're leaving yourself much worse off by not taking the initiative. Do it last minute and you're shooting yourself in the foot.

Similarly, too early and you're not quite getting it right.

Lewis' analysis found that the best time to renew, and keep costs as far down as they can be, was any time between 20 and 26 days.

"Leave it later and quotes can almost double. This is because insurance is priced on risk, and providers' 'actuarial charts' apparently show those who renew last minute are often a higher risk," Lewis says.

Martin Lewis fan saves £300

Over on TikTok, one fan of Lewis' car insurance advice revealed she saved a rather lovely £300 by taking on board advice similar to Lewis'.

TikTok influencer @shetalkscars shared the hack in a video that saw her explain that renewing your policy any time from 23 to 16 days before it ran out was the best time to bring costs down.

She said: "This is a car insurance hack I wish I knew years ago.

"Literally, this one little thing that costs you no money, just a bit of planning could literally save you hundreds off your car insurance for the year.

"I know because I’ve done it. It works. Get your car insurance between 23 and 26 days in advance, for some reason, this shows insurers that you're a safer driver.

"I don't know why that is. Anyway, it makes your insurance cheaper."

Other ways to bring down your car insurance

Lewis past advice on car insurance has involved multi-car cover.

This is where you sign up all the cars at one address to the same policy. It's something provided by some insurance providers, with a discount included.

And one more way to save the pennies is to combine your car insurance with your home insurance. Again, it's only something offered by certain insurance companies but certainly worth exploring.

Whatever you do, please don't just auto-renew.

Topics: Martin Lewis, Cars, Money, UK News, Cost of Living, Hacks, Travel, Driving