One Martin Lewis fan has revealed how she claimed back almost £2,000 by following his simple advice.

Lewis, the founder of the Money Saving Expert website, regularly takes to social media and television with the latest money advice as it crops up.

Appearing regularly on ITV1 and ITVX on The Martin Lewis Money Show Live, he will spend an hour every Tuesday evening going through some of the biggest cash saving deals you need to take advantage of if you can.

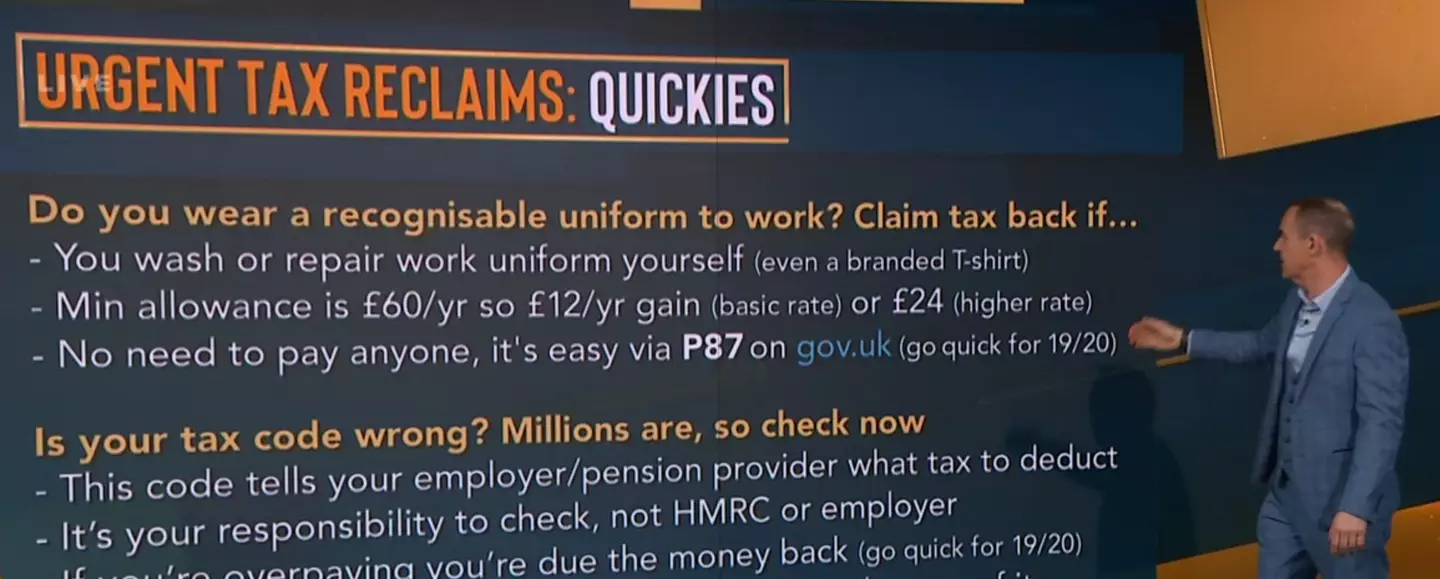

Some of the latest includes an update to anyone who wears a uniform to work.

There's also some massive advice regarding saving on your broadband bill after one viewer clocked up savings of more than £600 a year by following Lewis' rules.

Advert

The latest £2k saving was broadcast in this week's episode (12 March).

Writing in to Lewis, one viewer of the show - who gave her name as Julie - was over the moon at the benefit she got from listening to the financial expert.

Julie wrote: "Thank you to Martin and the team.

"Thanks to your show I have received £1,983.60 back after being on the wrong tax code."

What was she referring to? Making sure you are on the right tax code.

Advert

Lewis said on the show: "It is not HMRC's or your employer's responsibility to make sure this is correct, this is your responsibility.

"If you're overpaying you are due the money back."

What to do if you're on the wrong tax code

In a lot of cases, HMRC will do its best to automatically change it when your income changes (if it does at all).

Advert

But if HMRC gets the wrong information about what you earn you could get given the incorrect tax code and therefore taxed the wrong amount.

To correct your tax code, make sure HMRC has up-to-date details about your income.

If you think your tax code is wrong, you can use the check your Income Tax service to update your employment details.

You can also use it to tell HMRC about a change in income that may have affected your tax code.

Claiming back a tax refund

If you find yourself on the receiving end of a HMRC tax code update, you could have paid too much tax. Warning, though, as you could also have paid too little and need to cough up.

Advert

At this stage, HMRC will send you either: a tax calculation letter - known as a ‘P800’ - or a Simple Assessment letter.

Topics: Cost of Living, Martin Lewis, Money, TV and Film, UK News