Important tax changes have come in across the United Kingdom, impacting millions of us who take home a salary.

And Martin Lewis with his Money Saving Expert team is here to explain exactly what you should be doing to make sure your money is right, with a 'check now' warning issued in the latest MSE newsletter.

When are the new changes coming in?

A range of new policies were announced by the Chancellor of the Exchequer earlier this year in his spring budget, with a lot of them coming in at the start of the new tax year.

The tax year itself runs from April to April, meaning we entered the 2024/25 year four days ago without you maybe even realising.

Advert

"Forget 1 January, the New Year that matters is 6 April... the start of the New Tax Year, which has a material impact on the money in your pocket," the MSE newsletter says.

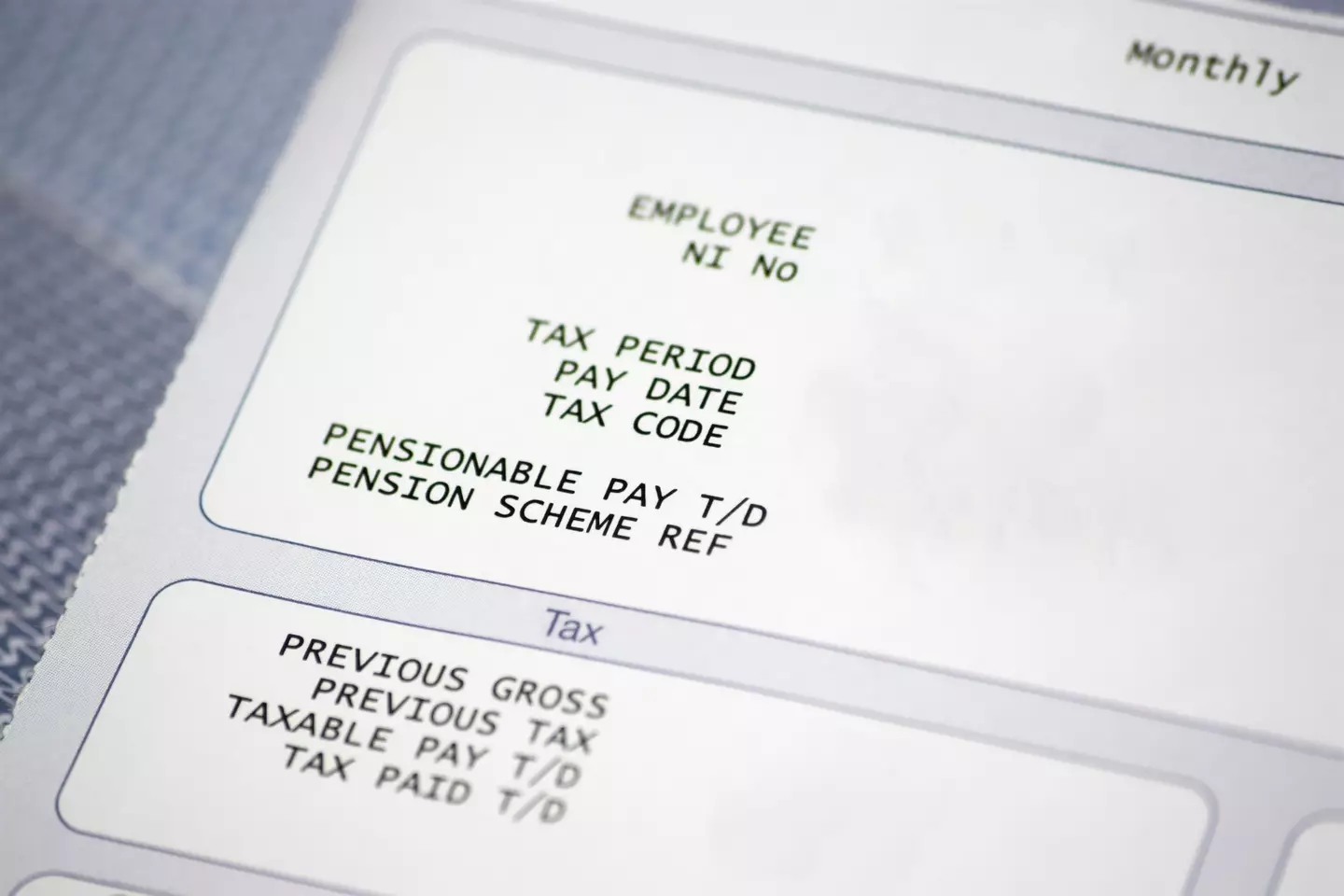

"It's when new tax codes start, ISA allowances reset, and this year there is a Child Benefit shake-up."

20 million impacted

One flagship policy in the Chancellor's spring budget was a massive taxation change to around 20 million of us who work in the United Kingdom.

The tax in question is National Insurance (NI), which you'll probably see on your payslip under the deductions column.

NI itself helps pay the country's benefits and pensions bills, with £168 billion collected by the government last year.

But for 2024/25, that number is set to be significantly lower.

Tens of billions lower, in fact.

What will you pay in National Insurance contributions?

Because of a massive cut to National Insurance, there will be a significant impact on your take-home pay if you make NI contributions.

As of 6 April, NI has been cut from 10 percent to eight percent.

That's on top of another two percent cut in the second half of 2023, meaning we'll be paying four percent less tax than we would this time last year.

What does it mean in real money?

The tax cut is for those who earn between £12,570 and £50,270.

If you earn £25,000, you'll get another £250 in your pocket every year. That's about £20 a month more in every pay packet.

Those earning £35,000 will get £450 a year, which comes out at £37.50 more a month.

And if you earn more than more than the top rate of £50,270, you'll get an extra £750 every year - or £62.50 a month.

Tax warning

Lewis and the MSE team warn that you likely wont get all of that money due to a thing called fiscal drag.

This is where incomes go up but tax thresholds remain the same. As a result, it increases people's taxable income without tax rates rising.

The MSE newsletter says: "Fiscal drag (frozen tax thresholds) eats some back.

"NI and income tax thresholds have been frozen since 2021 (though there have been slight changes in Scotland), while earnings have risen. The result... more of your income goes to tax."

You can check what you'll take home using the MSE income tax calculator.

Topics: Cost of Living, Jobs, Martin Lewis, Money, UK News