At this time of year, it starts to be a hard no to that mate always asking to go out and we become a little tougher at resisting the temptation of the things we definitely didn’t go into the supermarket for.

With the January pay day seeming like forever away and the holidays leaving our bank accounts crumbling, a little extra cash would be great right now.

So, good news, today (6 January) marks the start of millions of Brits seeing more money going into their funds.

Back in November, the government announced a change to National Insurance.

And it’s actually a good change – they’re reducing the rate.

Advert

Working Brits get charged for National Insurance similarly to income tax, except the money is allocated towards some of the safety nets built into society – like pensions, Jobseeker’s Allowance and Maternity Allowance.

If you’re a salaried employee then you’ll be paying into all of them, whereas cash from those self-employed only goes towards some.

Before today’s change kicked in, you pay no National Insurance on the first £242 you earn in a week, 12 percent of whatever you earn between £242.01 and £967 and if you earn anything over that a week then it's another two percent beyond that.

For example, if you earned £1,000 a week (get you) then you'd pay nothing on the first £242, £87 as your main rate of National Insurance and then an extra 66p on that final chunk of weekly earnings.

Advert

The change coming in today knocks that main rate down from 12 to 10 percent.

So, in that above example the reduction means the person earning £1,000 a week would now pay £72.50 on their earnings between £242.01 and £967, meaning they'd have an extra £14.50 in their pocket each week.

For Brits over a year, the average UK salary is £35,000 so this change will save the average of Brits about £450 a year.

The change will impact 27 million people aged between 16 and the state pension age, as Brits who work beyond pension age no longer pay National Insurance.

Advert

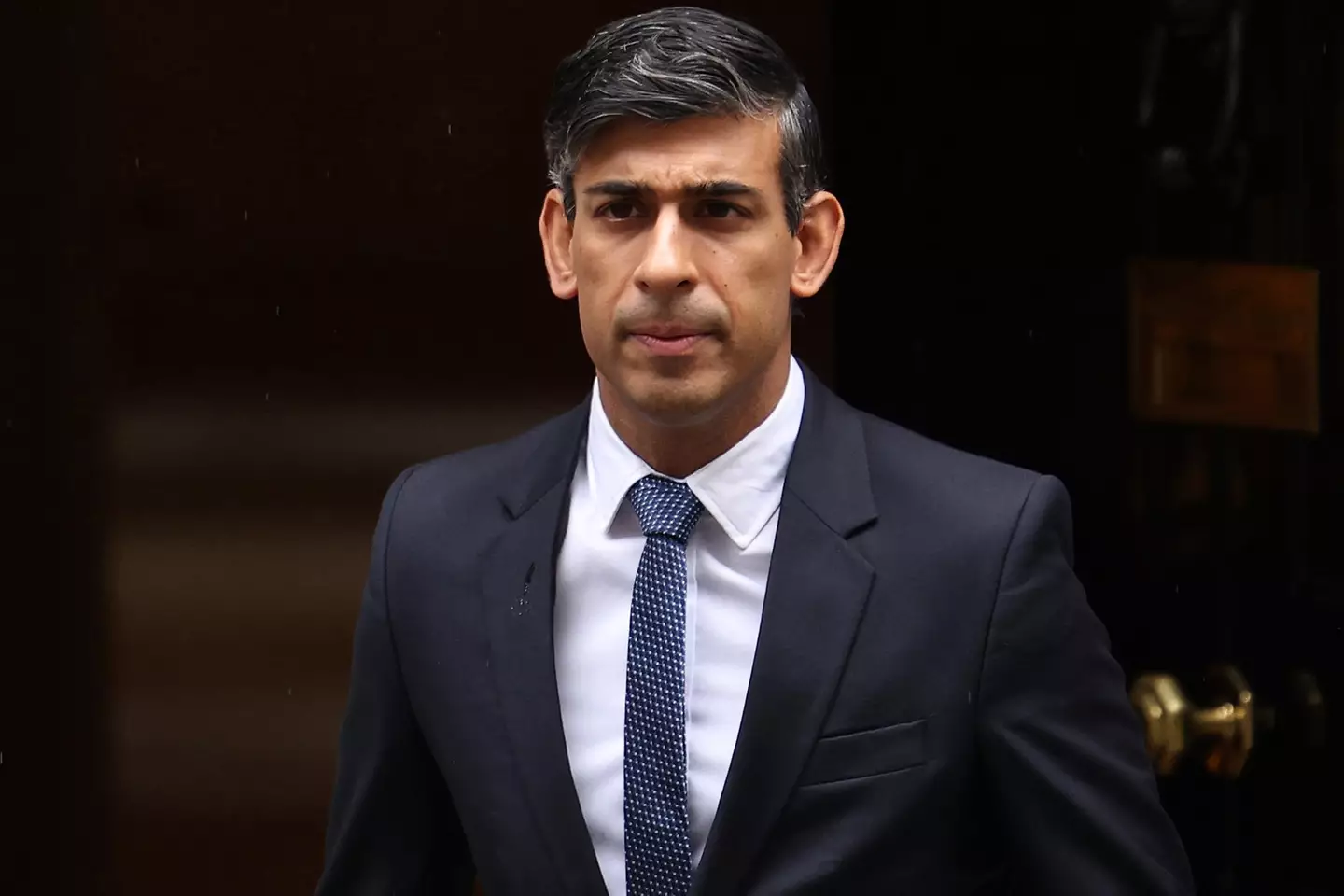

Prime Minister Rishi Sunak told a crowd in Mansfield about the cut to National Insurance earlier this week.

He said: "This Saturday, a big tax cut is coming in, every working person across the country is going to benefit from it. It’s worth £450 to an average person in work on the average salary.

"We want to do more because as we manage the economy responsibly, we can cut your taxes, give you and your family peace of mind, immediate relief from some of the challenges you’re facing and confidence that the future is going to be better for you and your children.

"That is the journey that we’re on."

However, according to Payscale the average salary in Mansfield is £26,000, so the people he spoke to might not be saving as much as that £450.

Topics: News, UK News, Money, Cost of Living