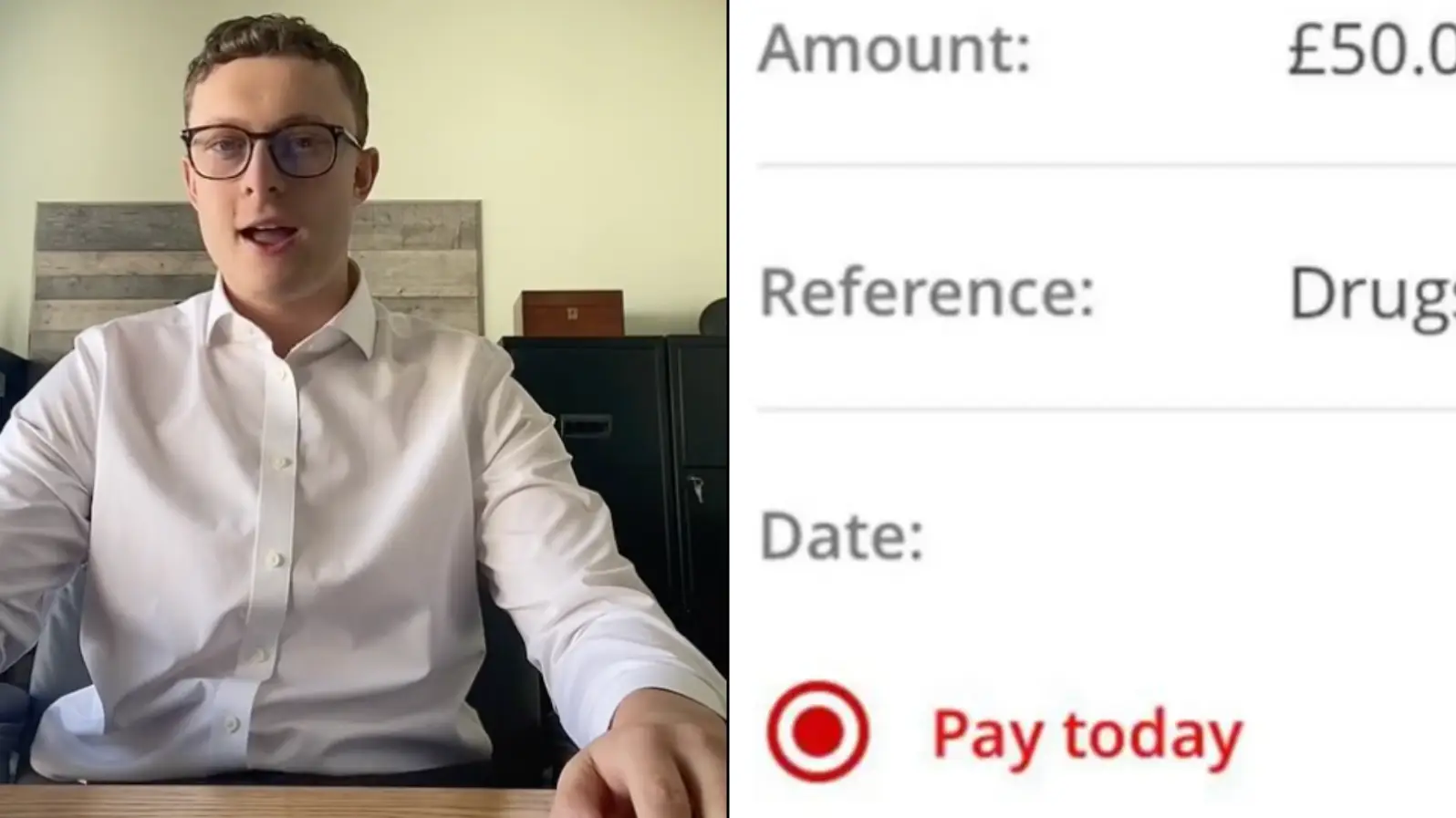

A mortgage adviser has warned people against using rude and inappropriate words on their bank statements. Watch here:

Now, you might think that buying a house - and the people who make a living in the world of buying and selling houses - would be a barrel of laughs; however, it turns out that's not always the case.

In fact, many people find it to be an incredibly tedious and soul-destroying process, what with all the form-filling, and the box-ticking, and the hoop-jumping.

Advert

Oh, and it's also a completely humourless affair - as one mortgage adviser has made perfectly clear on TikTok.

In a viral video, @mortgageadviser warned people against using rude or inappropriate words in their bank statements; instead, they should be as accurate and unimaginative as he was when he chose his TikTok handle.

After warning people against showing evidence of gambling in their bank statements, he added in a follow-up clip: "The second really important thing to avoid showing on your personal bank statements when applying for a mortgage are any rude or inappropriate references next to money that you and your friends send each other.

"Yes, as an adviser, it can be quite funny to read, but unfortunately lenders don't see it that way and they will ask questions, which can work out pretty unfavourably if they perceive you to be A - engaged in an illegal activity, or perhaps B - that you will be repaying the mortgage through the likes of 'drug money'."

Commenting on the clip, he added: "This completely depends on the bank & its underwriting process, some couldn't care less & some are required to flag it - better safe than sorry IMO."

The video has been viewed more than 900,000 times, and in the comments, people had plenty to say about the advice.

One person wrote: "Maybe lenders need to get a sense of humour and lend based on previous lending record only not jokes between friends."

Another said: "I had to explain when applying to rent a house that the reference 'money for druuuuuuugzzzz' was just my friend being funny."

While a third added: "Can't exactly stop my mates doing this."

To be honest, getting a mortgage is already hard enough at the moment.

House prices are currently rocketing in the UK, with recent research published by Halifax indicating that on average a home now costs more than seven times the average annual earnings.

Since the start of the pandemic in 2020, house prices have risen by 16.8 percent from £239,281, with average earnings rising by 2.7 percent from £38,374.

In the first quarter of 2022, the cost of an average home in the UK was £279,431, while annual average earnings of a full-time worker were estimated to be £39,402.

So yeah, writing 'nosh dosh' on your bank statements might be the least of your worries.