A new report reveals that companies prioritising their profits are apparently to blame for the cost of living crisis in Australia rather than rising wages.

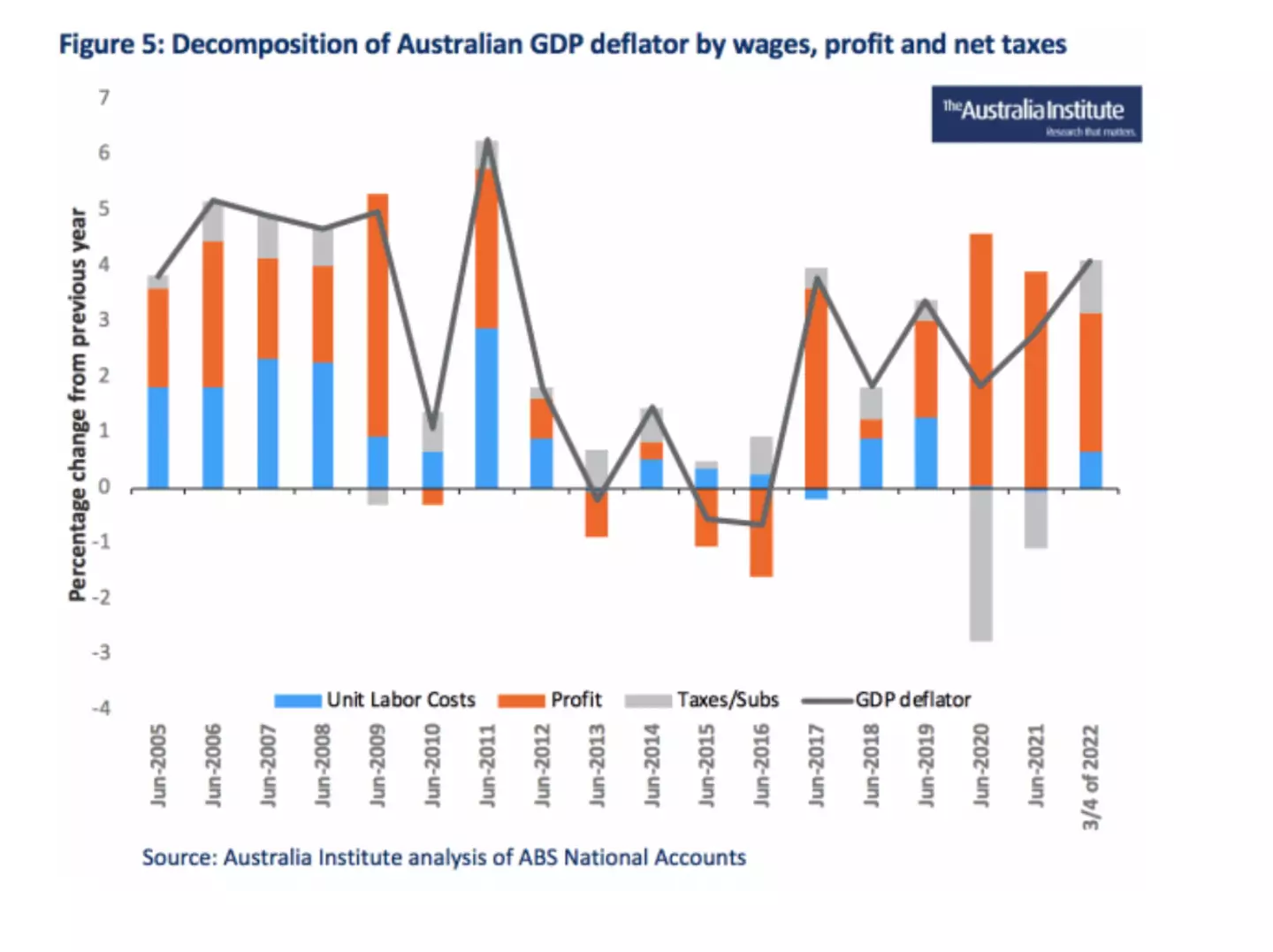

The report conducted by the Australian Institute shows that companies' high profits are responsible as wages made 'no contribution' to Australia’s rising inflation levels in 2019-2020 or 2020-2021.

Chief economist at the Australia Institute Dr Richard Denniss said: “Australia isn’t experiencing a wage-price spiral, it’s at the beginning of a price-profit spiral.

“The national accounts show it is rising profits, not rising costs, that are driving Australia’s inflation.

Advert

"While workers are being asked to make sacrifices in the name of controlling inflation, the data makes clear that it is the corporate sector that needs to tighten its belt.”

He added: “Wages made no contribution to Australian inflation in 2019-2020, or 2020-2021, and accounted for only 0.6 percentage points of the 4.1 percent increase in prices so far this financial year.”

The study also revealed company profits were at an all-time high.

The report also dismissed the notion that companies were ‘left with no choice but to raise prices’; instead, companies were lifting prices on their own terms.

Advert

It read: "Increasing prices in line with, or in excess of, rising costs is a choice to maintain or increase profit margins in Australia, even though the profit share of GDP is at a near-record high.

"It is clear that competition policy and other policies designed to control prices have a significant role to play in Australia."

The report also acknowledged that although prices had surged due to supply shortages caused by the Russia-Ukraine conflict and the NSW/Brisbane floods, the thirst for large profits was still mainly accountable.

However, as the analysis is based on the European Central Bank’s methods of observing the causes of inflation to ABS data, Economist Saul Eslak said that we shouldn’t rely on broad datasets to indicate where inflation was coming from, according to The New Daily.

Advert

“It is fair to attribute a good deal of the rise in inflation to business’ ability to pass on cost increases,” Mr Eslake said.

“Whether that’s merely to maintain their profit margins or expand them further is something that can probably only be ascertained on an industry-by-industry basis.”

According to the Reserve Bank of Australia (RBA), inflation is sitting at 5.1 per cent, the highest level in 20 years and that rate is expected to climb to seven per cent.

9News reports that senior economist at AMP Diana Mousina said that while Australia’s inflation seems a lot lower than other nations, the worst is still yet to come.

"The Australian inflation peak will come later compared to the rest of the world," she said.