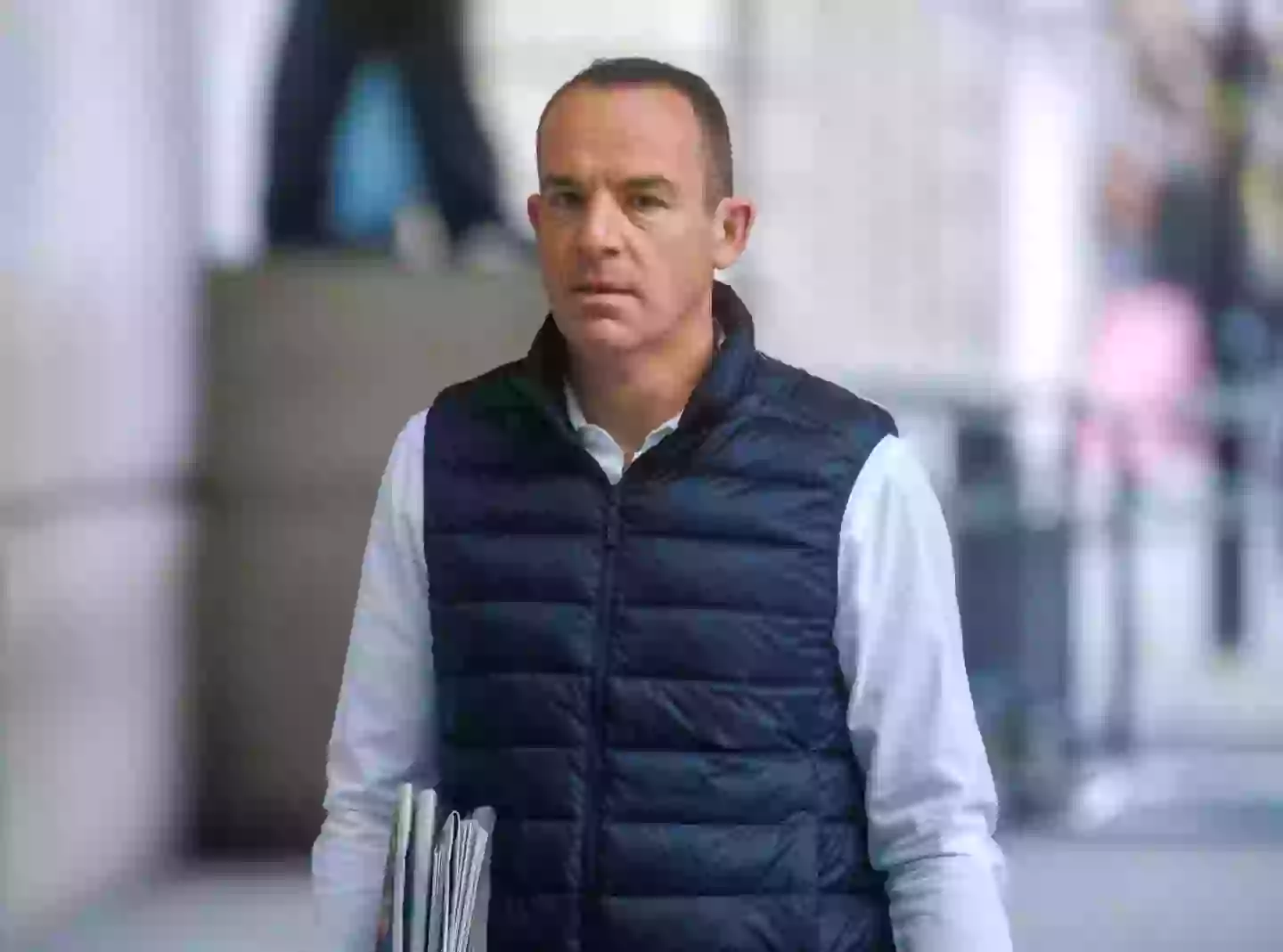

Martin Lewis has done it again. Whether it's telling us all how to save money on our holidays or energy bills, the finance whizz has helped millions keep more of their cash.

And his latest titbit could be vital in helping people look after the pennies when it comes to getting their car insurance.

After sorting out the MOT, it is perhaps one of the most dull jobs drivers have to sort out, and it can also be one of the most expensive.

Advert

However the Money Saving Expert says there's a simple trick that could help you save hundreds every year.

Martin revealed previously that the best time to buy your car insurance was between 20 and 26 days before it is due.

But according to MSE, the best day to sort your cover out is 23 days before, as it can see your policy cut by half. Which isn't too bad, is it?

The advice site analysed over 70 million quotes from comparison sites to find this sweet spot.

Advert

It should be noted, though, that not all insurance firms are listed on comparison sites, so you will need to get in touch directly with them if you want a specific quote that's not available.

And if you miss this particular day, don't worry, the company also found that quotes were substantially cheaper a couple of days either side of it too.

Speaking previously about the issue, Martin explained that it's not just about renewing, it's about the insurance company creating a picture of the customer.

Martin said: "It's all based on actuarial risk."

This is when insurers compare how many people have claimed and what information they put on their applications.

Advert

So it's based on what the majority of other drivers have done in the past.

Another piece of outside-the-box thinking is choosing comprehensive cover as opposed to a third-party fire and theft policy.

Though it may not seem so at first, this can often work out cheaper because providers view you as a lower risk. Again, this is purely based on numbers.

He also advised that: "Adding an extra driver can cut your costs - it's especially useful for younger drivers."

Advert

However, you should be careful NOT to put them as the main driver, because this is called 'fronting' and is illegal.

His final pearl of wisdom is comparison sites: use as many as you can. This is because insurers have deals with sites, meaning they may cost more or less depending on which one you use.

"I use at least three," Martin said.

Topics: Martin Lewis, Money, UK News