A teacher has issued a warning after having his life savings drained while he was on holiday due to his identity being sold on the dark web.

The Brit had travelled to Cornwall with his wife Davina, a nursery teacher, in August 2021 - their only time of the year to get away from the stresses of teaching children.

Matthew Shaw, 27, was on his way to go jet skiing for the first time before getting an unexpected notification from his bank telling him he'd just splashed out three and a half grand on a hotel, though its name and location were left out.

Advert

After a quick call to his bank, First Direct, it was found that someone in Romania opened an account in his name via a digital financial services company, using his identity and linking it back to his UK bank account.

He recalled: “I thought, ‘Oh my God, what is this?’, and I rang First Direct straight away and said, ‘This is not me’.

“They were going through their security questions, but I was just panicking and thinking, ‘All my money’s gone – that was our savings for a house and it’s all gone’,” he admitted.

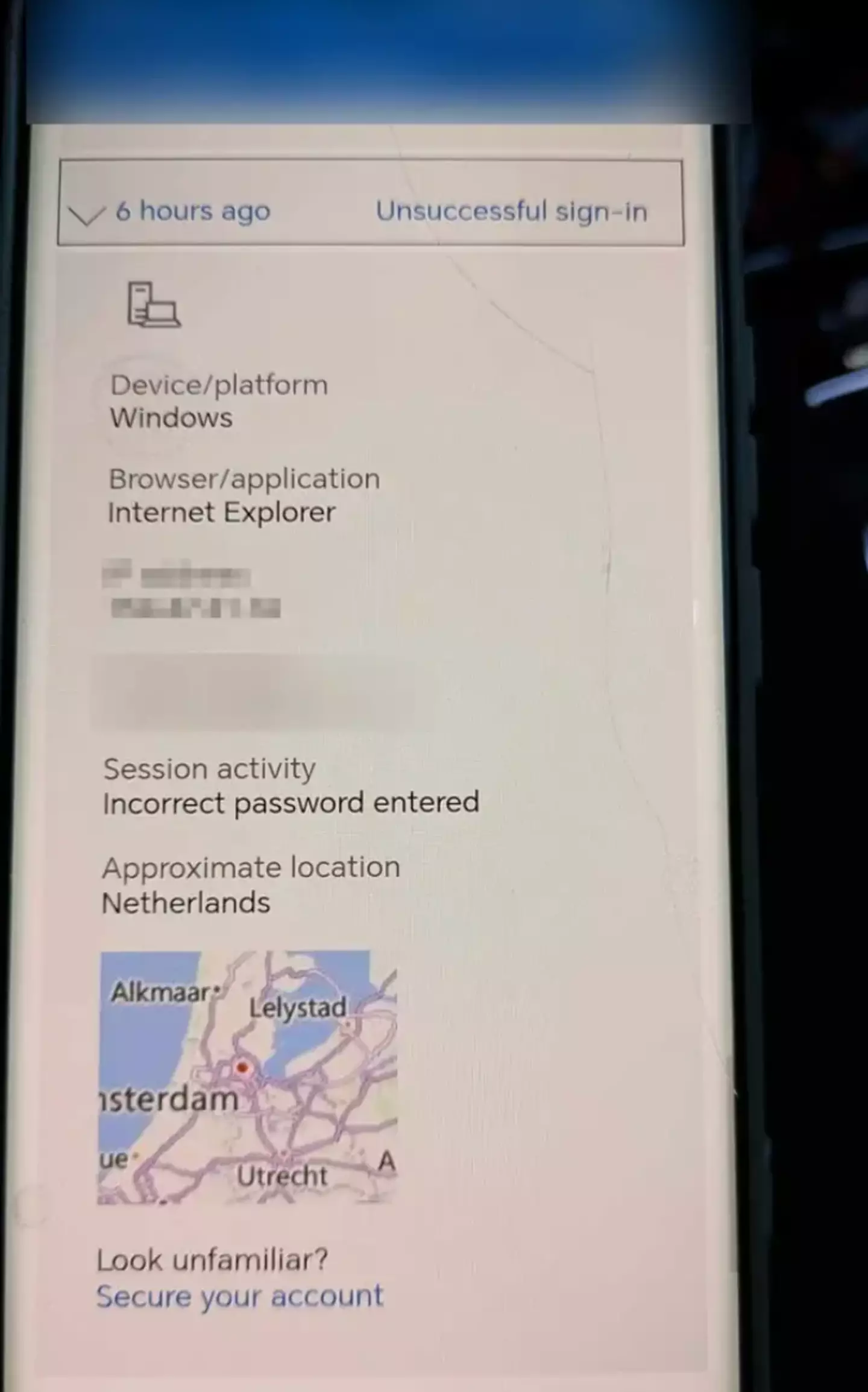

Not just that, but the Romanian hacker also obtained Matthew's details through the dark web and paid for the hotel, something which can cost as little as $10 (£7.65).

Before you begin to think he uses the same password for everything, the teacher claims to be tech-savvy, even having different passwords for all his accounts and changing his email address often, all in a bid to avoid being the victim of this exact crime.

Advert

After the illegal transaction, Matthew had just £20 left in his account, meaning the devastated couple had to cancel all of their pre-booked plans and leave a week early so they could afford petrol to get back home to Gloucestershire.

“Davina was upset, crying, and on the way home it was a quiet car journey,” Matthew explained.

“I think we were both in shock – our holiday, that we go on once a year, has been ruined by someone who is probably doing this 10, 11 times a day, and you just think, ‘Why have they chosen us?’

“I was just thinking, ‘What could I have done better?’ You start to blame yourself,” he admitted.

Advert

Luckily, it took just a week for First Direct to complete its investigation despite Matthew feeling 'concerned', and the bank refunded the £3,500 payment, which was a 'relief' to the couple.

But the stress continued.

Matthew was then put on a 12-month fraud prevention programme, which meant he had to go through longer processes when making large transactions, using a credit card, setting up a new account or getting a loan.

According to the 27-year-old, it could take hours, and though it was 'frustrating', it also meant he was feeling 'secure' after the ordeal.

Advert

He highlighted: “At the time, it was very frustrating to sit and do a million security questions… and trying to apply for things was a nightmare, but reflecting on this, I was grateful.”

Since then, the teacher has added more security measures to his accounts, including the all important two-factor authentication, something which he didn't have set up at the time of the scam.

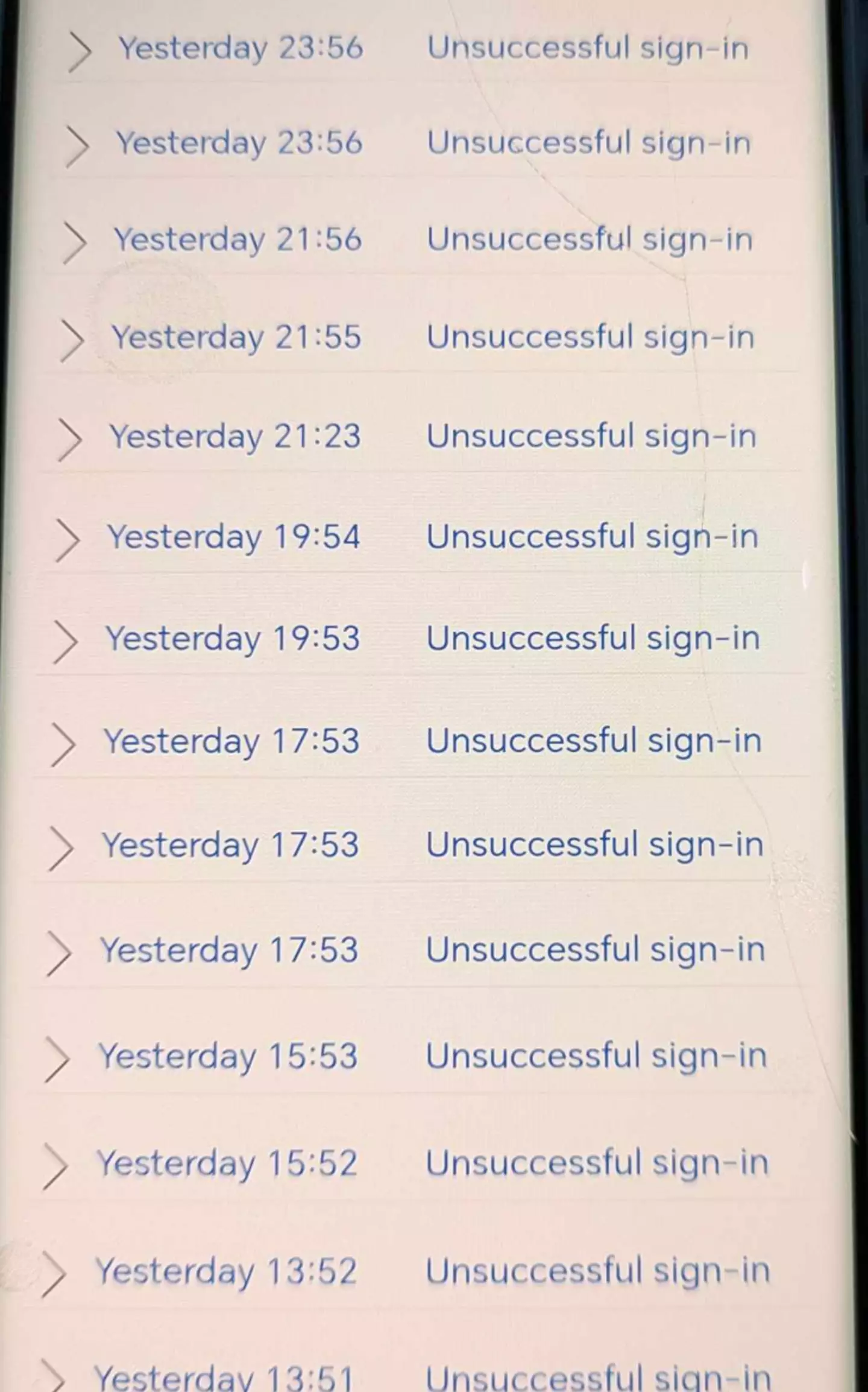

He no longer uses the hacked email address, but revealed that people are still trying to get his personal information through there.

“I have about six or seven notifications a day, saying, ‘Is this you? Confirm the number to get into your account’,” Matthew said.

“I don’t use that email now and I deleted all my personal information off it, but I still have notifications coming from that email.”

Advert

He concluded: “You just don’t think it’s going to happen to you until it happens.

“If I can educate at least one person – like my job as a teacher – then I’ve done my job.”

A First Direct spokesperson said: “Protecting our customers from fraud and scams is a key priority for us and we have a range of features in place to spot unusual activity on an account and protect our customers’ money.

“In this case, we’re really pleased we were able to intervene when Mr Shaw’s details were compromised and refund the money promptly.

“It is also standard practice for us to offer additional support to those customers who are victims of fraud, to give them extra assurances when making further payments so they feel confident and supported when managing their account.”