Last week US President Donald Trump announced sweeping, punishing tariffs on pretty much every country, some of them rather mystifying.

The stock markets have since reacted, and to give you a general gist of what they've been doing imagine a red line going down.

With the value of stocks tumbling people are trying to sell up and convert their depreciating portfolio into good old cash again, and if fewer people want something then the value is going to drop even more.

Advert

Even cryptocurrencies have been struggling, with Bitcoin having dropped to around £58,700 which has pretty much eliminated the increase in value it had after Trump won the election last year.

UK Prime Minister Sir Keir Starmer has called for 'cool heads', saying the economic turbulence was 'not a passing phase'.

So how did we get here and what happens now?

Biggest two day wipeout in US history

3 and 4 April represented the worst two consecutive days in the history of the US stock market, with some $6.6 trillion worth of value being wiped off the stocks.

Advert

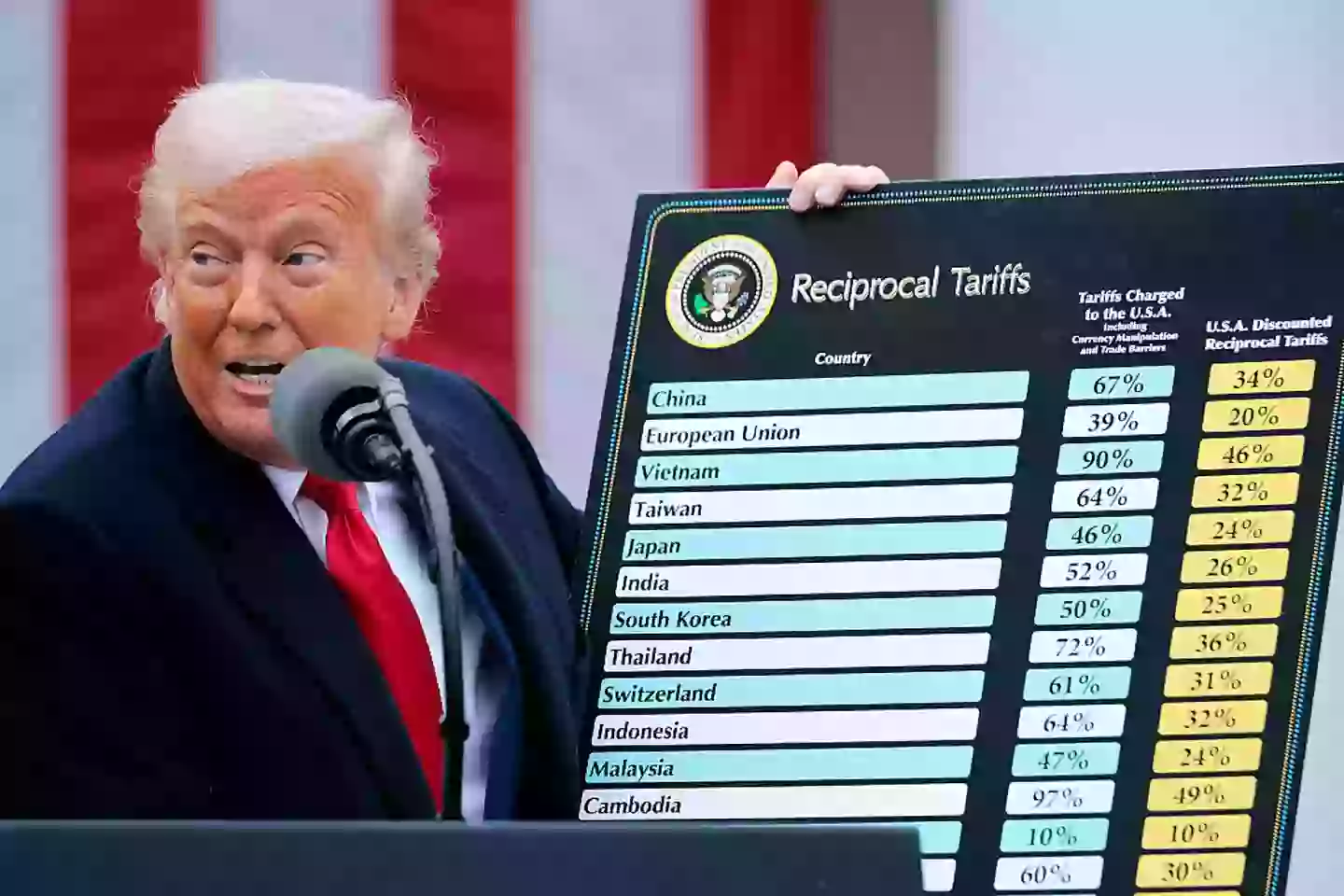

These two days of disaster followed Donald Trump's announcement the previous day (2 April) that he was going to be imposing sweeping tariffs on pretty much every country in the world, barring a handful of exceptions.

The full list of tariffs imposed was staggering, and the figures Trump presented which claimed to represent the tariffs other countries were imposing on the US came into question.

If anyone was hoping that the damage would be restricted to the two days immediately afterwards then they were sorely mistaken.

The 'bloodbath'

Euronews described the impact of the tariffs on European markets as a 'bloodbath', laying out how things had not been this bad since the Covid-19 pandemic.

Advert

Stock markets all around the world fell sharply and experienced terrible days not seen since countries started imposing lockdowns.

In the UK the FTSE 100 hit its lowest level for a year, while the situation in Asia was described as 'two horrible days in one' in their first opportunity to respond to Trump's tariffs.

Germany's Dax index and France's Cac 40 index both also saw severe dips.

The US stock market opens... down

When the US stock market opened today (7 April) at 2:30pm BST the Standard & Poors 500 was down 3.4 percent, the Dow Jones dropped by 3.1 percent lower, and the Nasdaq has fallen 4.1 percent lower.

Advert

Minutes later they'd all slid into worse positions before jumping up due to a rumour that Trump was considering pausing the tariffs for 90 days.

When the White House said this was 'wrong' stock owners started selling again and the value dropped once more.

All in all, a very f**king bad day at the office to follow on from the s**t sandwich that was the end of last week.

Only one of the top 500 billionaires in the world hasn't lost money from this, that being famously shrewd investor Warren Buffett after he started selling shares in US businesses once Trump returned to the White House.

What does it mean for the world?

Trillions of dollars in stock value is gone and so many people who are invested in the stock market have seen their investments suffer as a result of Trump's actions.

Advert

There are now concerns that there could be a global recession.

JP Morgan raised its estimations for the risk of a global recession to 60 percent, while Goldman Sachs raised theirs to 45 percent, having previously cranked it up from 20 percent to 35 percent last week.

It'll be several months before we can officially enter a recession, but businesses are expecting that with the tariffs it'll mean higher costs and lower profits and economic confidence is low.

Eyes will be on when things might start to stabilise in the stock markets around the world, and how many more trillions of dollars in value will evaporate.

We now move forward into that uncertain future, and in markets uncertainty tends to mean things get worse.

What does it mean for you?

It's not great to be in a boat that is currently rocking quite alarmingly.

It'll be worst of all if you're invested in the stock market, and you very well might be even if you don't realise that you are.

Many people are part of pension schemes which are invested in the stock market, and falls all over the market are likely to have an adverse reaction which may affect those funds.

Elsewhere, the impact on prices remains to be seen.

Oil prices are falling, which might mean a few pence off at the petrol pump, but if businesses are looking to make more money and cover their rising costs then plenty of other products may go up in price.

According to the BBC, some people may be able to make money off this situation by 'buying the dip' and investing in stocks right as they hit the bottom of their value, so that if and when the market recovers they can make some money by selling up when the stock price rises again.

Trouble in the stock market is also likely to mean job losses or fewer people being hired as companies can't afford larger workforces.

Topics: Donald Trump, US News, World News, UK News, Money